Barley Flake Market to Reach USD 15.6 Billion by 2035, Driven by Organic Demand and Food Innovation

The Barley Flake Market is set for steady growth, driven by rising health-conscious diets and expanding use in breakfast cereals and functional foods.

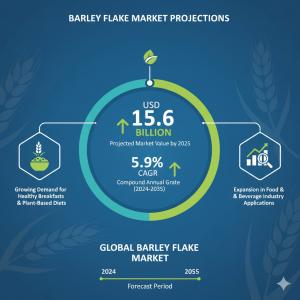

NEWARK, DE, UNITED STATES, September 5, 2025 /EINPresswire.com/ -- The global barley flake market is entering an exciting growth phase, fueled by rising consumer preference for nutritious, clean-label foods and innovative product applications. According to the latest market report, the industry is estimated at USD 8.8 billion in 2025 and is projected to nearly double, reaching USD 15.6 billion by 2035, growing at a steady CAGR of 5.9%.

As both established brands and emerging manufacturers invest in expanding product portfolios, the industry is witnessing a wave of innovation—from organic offerings to advanced processing technologies that enhance quality and shelf life.

Key Highlights at a Glance

• Market Size 2025: USD 8.8 billion

• Forecast 2035: USD 15.6 billion

• CAGR (2025–2035): 5.9%

• Leading Segment by Nature (2025): Organic (42.9%)

• Top Growth Regions: North America, Asia-Pacific, Europe

• Prominent Companies: Shiloh Farms, Bob’s Red Mill, Briess Malt & Ingredients Co., Eden Foods, King Arthur Flour, Vee Green Organic Life Care Pvt. Ltd., Helsinki Mylly Oy, Rude Health, among others.

Why Demand for Barley Flakes is Rising

Barley flakes are increasingly recognized as a high-fiber, nutrient-rich alternative in modern diets. With consumers juggling busy lifestyles, quick-to-cook and wholesome foods have become more appealing. Barley flakes, which offer essential vitamins, minerals, and fiber, align perfectly with these needs.

The organic food movement has further propelled demand. Shoppers are increasingly looking for chemical-free, non-GMO grains, pushing organic barley flakes to capture 42.9% of the market share in 2025. Established players like Bob’s Red Mill and Shiloh Farms have already expanded their organic portfolios, while newer entrants like Naturally Yours and Vee Green Organic Life Care are tapping into the growing demand for sustainable agriculture products.

Segmental Insights

Organic: The Leader in “Nature” Segment

Organic barley flakes are expected to dominate revenues by 2025. Consumers are actively choosing products free from synthetic pesticides, aligning with global clean-label trends. With premium pricing and strong retail demand, the organic segment ensures profitability for both large-scale producers and smaller niche suppliers.

Hulled Barley Flake: Nutrition First

Among product types, hulled barley flakes will account for 29.6% of revenues by 2025, thanks to their superior nutritional profile. Companies such as Briess Malt & Ingredients Co. and Helsinki Mylly Oy are emphasizing hulled variants to meet the rising demand for fiber-rich, minimally processed foods.

Food & Beverage: The Largest End-Use Industry

The food and beverage sector is expected to dominate with 51.3% of the market in 2025. Barley flakes are being widely incorporated into cereals, bakery items, snacks, and functional beverages. Established brands are innovating with multigrain blends, while startups are targeting health-conscious consumers with protein-enriched snack bars and plant-based products.

Regional Growth Story

Asia-Pacific: The Growth Powerhouse

Asia-Pacific is leading the charge as consumer interest in whole-grain breakfast foods and multigrain cereals rises. Local manufacturers are diversifying portfolios, offering barley-based cereals and snacks to capture this momentum. India and China, with their booming middle-class populations, represent significant demand hubs.

North America: Health-Driven Expansion

North America is set for robust growth due to rising consumer awareness of nutrition and functional foods. Companies like Eden Foods and Rude Health are capitalizing on this trend with innovative product launches tailored for health-conscious consumers.

Europe: A Mature yet Dynamic Market

Europe continues to embrace barley flakes, especially in the organic and functional food categories. With a strong tradition of whole-grain consumption, manufacturers in the region are focusing on sustainability and clean-label certifications to remain competitive.

Key Growth Drivers

1. Health & Wellness Trends: Consumers are prioritizing foods rich in fiber, vitamins, and minerals. Barley flakes offer an easy, nutritious solution.

2. Clean-Label Preference: Demand for natural, organic, and non-GMO products is boosting organic barley flake sales.

3. Innovation in Food & Beverage: Companies are incorporating barley flakes into cereals, biscuits, beverages, and health bars, creating versatile product applications.

4. Convenience Factor: Quick cooking times and adaptability make barley flakes an attractive option for modern lifestyles.

Industry Challenges

Despite strong growth, the barley flake market faces competition from oats, which dominate consumer preferences due to their established use in cereals, beverages, and snacks. Additionally, low consumer awareness in certain markets remains a hurdle. To overcome these challenges, companies are ramping up marketing efforts and product diversification.

Competitive Landscape: Established & Emerging Players

The market is highly competitive, with global giants and emerging innovators both striving for growth.

• Established Leaders: Brands like Bob’s Red Mill, Shiloh Farms, and Briess Malt & Ingredients Co. are strengthening their supply chains, expanding organic offerings, and investing in advanced processing to improve texture and shelf life.

• Innovative Entrants: Companies such as Vee Green Organic Life Care Pvt. Ltd. and Naturally Yours are making waves in Asia with clean-label and plant-based product innovations.

• Diversification Strategies: Firms like King Arthur Flour and Eden Foods are integrating barley flakes into wider portfolios of baking and natural food products, while Chicago Brew Werks is exploring opportunities in brewing and specialty applications.

Together, these players are driving industry transformation, balancing tradition with innovation.

Request Barley Flake Market Draft Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-8309

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

The Road Ahead

As global consumers continue shifting toward healthier, more sustainable diets, the barley flake market is poised for long-term growth. With organic leading the way, hulled variants capturing attention, and food and beverage applications expanding, manufacturers—both established and new—have significant opportunities to scale and diversify.

From small niche brands innovating in clean-label foods to global players optimizing production and supply chains, the market’s future lies in a mix of sustainability, nutrition, and convenience.

By 2035, the barley flake market is expected not only to reach USD 15.6 billion but also to stand as a symbol of how consumer health trends can reshape entire food industries.

Explore Related Insights

Barley Market: https://www.futuremarketinsights.com/reports/barley-market

Barley Protein Market: https://www.futuremarketinsights.com/reports/barley-protein-market

Malted Barley Flour Market: https://www.futuremarketinsights.com/reports/malted-barley-flour-market

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.